Achieving financial freedom and managing your money responsibly are undoubtedly essential goals. However, it’s equally important to practice self-care and treat yourself from time to time. The good news is that pampering yourself doesn’t have to break the bank or derail your financial plans. In this article, we’ll explore ways to indulge in self-care and treat yourself while still maintaining financial discipline and working towards your financial goals.

Editorial Note: We earn a commission from partner links on Money Unscripted blog. Commissions do not affect our editors' opinions or evaluations.

Establish a Self-Care Budget

The first step in pampering yourself without compromising your financial goals is to allocate a portion of your budget specifically for self-care. Just like you budget for bills and savings, setting aside money for self-care ensures you can enjoy treats guilt-free.

Prioritize Experiences Over Things

Consider prioritizing experiences over material possessions. Going for a hike in nature, having a picnic, or exploring a new hobby can be enriching and often more budget-friendly than buying expensive items.

Take Advantage of Free or Low-Cost Activities

Many cities offer free or low-cost events and activities, from art exhibitions to outdoor concerts. Keep an eye out for such opportunities to enjoy entertainment and pampering without spending much.

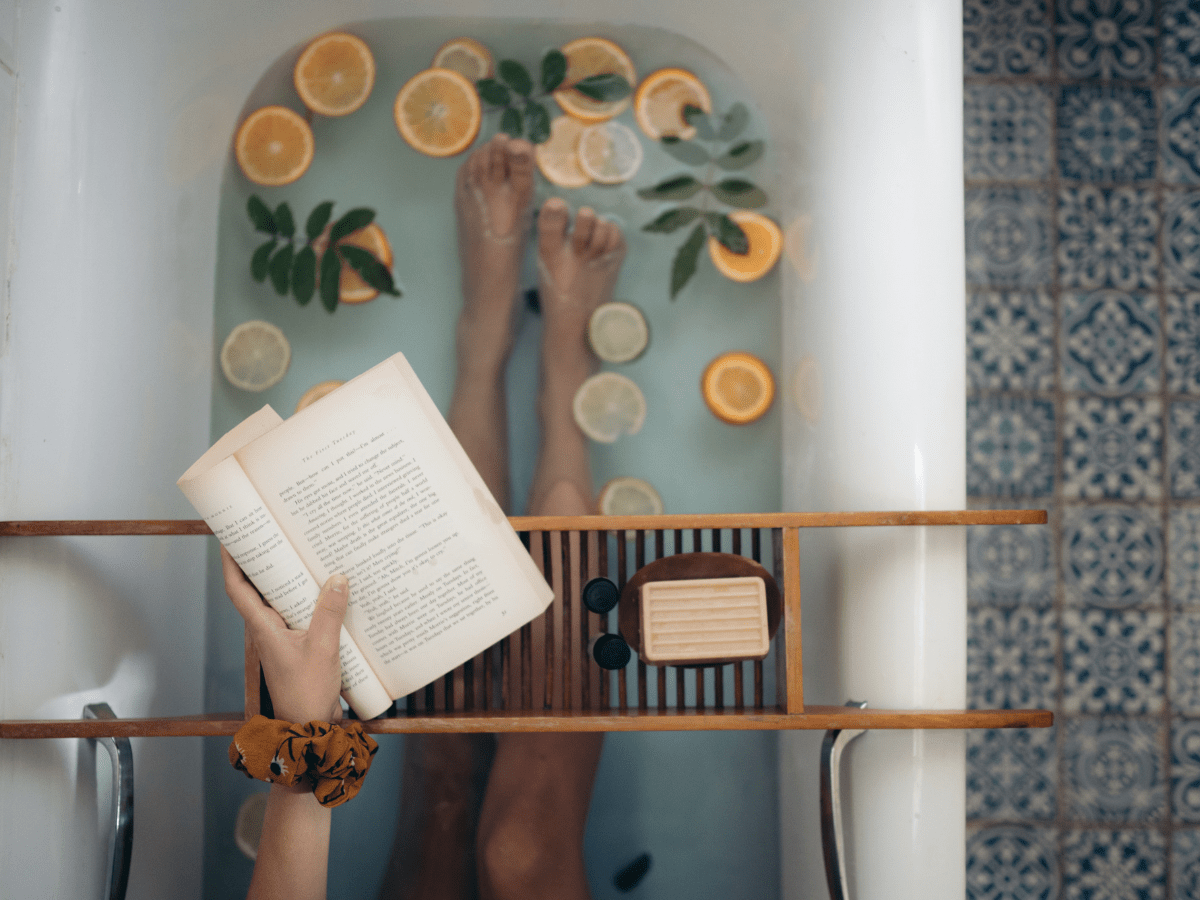

DIY Spa Day

Create a spa-like experience at home. Run a warm bath, use affordable skincare products, and play soothing music. DIY facials, manicures, and pedicures can be both relaxing and cost-effective.

Coupon and Discount Hunting

Before splurging on self-care purchases, search for coupons, discounts, and special promotions. Many businesses offer deals that can significantly reduce the cost of pampering.

Set Spending Limits

When treating yourself to a shopping spree or dining out, set a spending limit and stick to it. This prevents overspending and keeps your self-care activities in check.

Explore Free Educational Resources

Investing in your personal and professional development can be a form of self-care. Look for free or low-cost online courses, webinars, or workshops to enhance your skills and knowledge.

Plan for Special Occasions

Instead of making impromptu splurges, plan for special occasions or rewards within your self-care budget. Knowing when and why you’re treating yourself can make it more enjoyable and intentional.

Treat Yourself Mindfully

Practice mindful spending by asking yourself if a purchase aligns with your values and whether it genuinely brings you joy and relaxation. Mindful self-care can be just as satisfying as extravagant splurges.

Make Homemade Treats

Prepare your favorite meals, snacks, or desserts at home. Cooking can be therapeutic, and enjoying homemade treats can be more budget-friendly than dining out.

Explore Minimalist Living

Embrace a minimalist lifestyle by decluttering your space and simplifying your belongings. Focusing on what truly matters to you can lead to a more intentional and satisfying form of self-care.

Reward Yourself Milestone by Milestone

When you achieve significant financial milestones or goals, consider rewarding yourself with a well-deserved treat. This creates a positive reinforcement loop for responsible money management.

Bottom Line

Pampering yourself and practicing self-care are essential aspects of maintaining balance and well-being in your life. While achieving financial freedom and managing your money wisely are vital, they should not come at the cost of neglecting your own needs and desires. By budgeting for self-care, seeking cost-effective alternatives, and practicing mindful spending, you can enjoy the benefits of pampering yourself while still staying on track towards financial success.

Remember that self-care is an essential component of a healthy financial journey, and it’s a way to acknowledge and appreciate your hard work and dedication to your financial goals.

Our courses:

1. How to master your money mindset

3. How to build an emergency fund

5. How to create multiple streams of income

6. Investment Guide: What’s your ‘Why’ in investing